Michigan Child Support Attorney

Child support is a crucial, legal obligation that protects the financial well-being of children whose parents are separated, divorced, or never married. In Michigan, child support is governed by specific guidelines and regulations. This support covers a variety of expenses including: housing, food, clothing, education, and healthcare. In order to receive child support, a motion must be filed in County Court. So, the use of a child support lawyer is highly recommended in these cases.

As a family law firm with decades of experience, Kelly & Kelly P.C is highly experienced with legal aspects involved with child support in Michigan. You can learn more about these aspects below.

What is Child Support?

Child support is defined as a court-ordered payment of money from one parent of a child to another. These payments may include healthcare, child care, expenses for education, etc. Children have an inherent right to the support of their natural or adoptive parents and there are specific legal obligations in Michigan for both parents to provide necessary support for a child. A child support lawyer understands these obligations and can provide guidance in determining what type of support a child and spouse are legally entitled to.

Who Receives Child Support?

In Michigan, the custodial parent, legal guardian, or caretaker who has primary physical custody of the child usually receives child support. The person who gets the child support is the “payee.” The person who pays the support is the “payer.” Michigan has a specific formula that calculates the child support amount. Your attorney can assist you with this calculation.

How Is Child Support Calculated in Michigan?

Child support is calculated using the Michigan Child Support Formula. The formula considers several factors including:

- Income of both parents

- Number of children

- Childcare costs

- Healthcare costs

- Parenting time

- Other children living with either parent

- Educational costs

- Special needs costs

Parents may use the Michigan Child Support Formula Calculator available on the Michigan Department of Health and Human Services website. This may guide you to estimate child support. Of course, a child support attorney may assist you with this complicated process.

Michigan Child Support Formula

The Michigan child support formula considers the needs of the child and the resources of the family and assigns the child a share of those resources in the form of payments. The formula will consider the parents income, the allotment of custody and parenting time of each parent and the number of children to be supported. The formula will also consider the division of health care costs and child care expenses, etc.

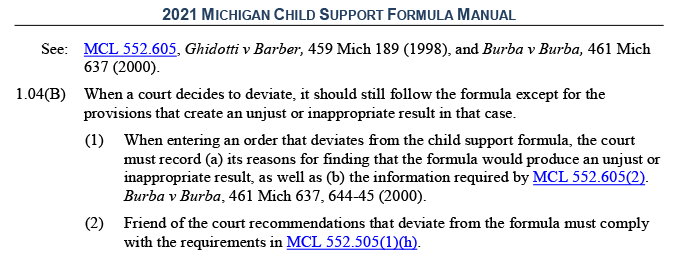

A court must order support in an amount determined by the formula unless the court finds that application of the formula would be unjust or inappropriate with specific facts on the record to support the deviation.

The Michigan family court can consider an agreement between the parties but the court does not need to follow the agreement.

Who Orders Child Support?

The judge orders child support according to the Michigan Child Support Formula. If you feel the amount is unfair, you must fill out a special legal form called the Uniform Child Support Deviation Addendum. Your attorney will help you with this. It’s important to note that there are 20 deviation factors that you may consider if you feel the amount is too high or too low. Once again, an experienced family law attorney can guide you through this complicated process.

The judge’s child support order is called a Uniform Child Support Order (UCSO). It includes the base amount of child support and any medical support. For example, one parent will be ordered to pay healthcare costs for the child. Remember, the Court’s main concern is the well-being of the child.

How Is Child Support Collected and Disbursed in Michigan?

Child support payments are usually collected and disbursed through the Michigan State Disbursement Unit (MiSDU) or the Friend of the Court (FOC). Often the non-custodial parent’s employer withholds the child support payment from the employee paycheck and sends it to the disbursement agency. Other times the non-custodial parent pays MiSDU directly. The custodial parent may receive payments through direct deposit, a prepaid debit card, or by check. MiSDU or FOC keeps track of all payments and disbursements. This arrangement protects both parties.

What Happens When the Payee Doesn’t Pay Child Support?

When the non-custodial parent fails to pay court ordered child support the custodial parent may take legal steps to enforce the child support order. Michigan offers several options:

- Income withholding- If this is not in place, and the non-custodial parent is employed this can be ordered.

- Tax refund interception- The state can intercept the state and federal tax refunds of the non-custodial parent.

- Liens and property seizure- The state may place liens on property or seize assets to collect past due child support.

- Driver’s license suspension- The state may suspend the driver’s license of the non-custodial parent for failure to pay child support.

- Contempt of court- The court may hold the non-custodial parent in contempt of court which may result in fines, probation, or jail time.

Basically, Michigan considers the financial well-being of children extremely important. Therefore, it remains vital that both parents remember their responsibilities regarding their children.

Can Child Support Ever Be Modified?

Yes. Child support orders may be modified in Michigan under certain circumstances. Either parent may request a modification. Generally, if there’s a change in income, or child’s needs, or a change in custody arrangements a modification may be granted. Contact your attorney for advice on this matter.

A change to either parents income or the amount of parenting time can justify a change in child support. But when a party voluntarily reduces or eliminates income and the court determines that a party has the ability to earn an income and pay the support, the court does not need to lower the amount. This is called potential income, and this could be a major issue for a parent who was once earning a high salary, and now has a reduced or no salary.

A judge will determine the potential income of the parent by looking at that parent’s education, experience and availability of opportunities in the job market.

Determining Modified Child Support

When determining the modified amount, the court will apply the Michigan child support formula, but can deviate from the formula if it finds that the application of the formula would be unjust or inappropriate, and it is backed up by specific findings.

It’s important to note, parents cannot use this modification to “get out” of payment. Parents may not bargain away, limit, or restrict modifications because a child is entitled to adequate support and to do so would usurp the court’s authority.

Any agreement to put a limit on child support will be unenforceable in Michigan. This is different from the parties right to limit or agree to no spousal support.

The State of Michigan can suspend the driver’s license of a parent who fails to make payments. This also includes occupational licenses such as law, real estate, police officers, day care, building contractors, medical licenses, and recreational and sporting licenses such as hunting and fishing.

Child Support and Healthcare Costs

In Michigan, both parents are responsible for the health care costs of a child. This includes ordinary medical care provided by health care professionals, extraordinary medical expenses, which are costs over the ordinary expenses along with general health care insurance coverage.

The courts will order one or both parents to maintain health care coverage for the children if it is available as a benefit of employment or at a reasonable cost. If the parents do not have health insurance, they must share in the cost of any medical expenses not covered by insurance.

Post Majority Support

A Michigan court may order what is called post-majority support for a child between the ages of 18 and 19 1/2 if the child is still attending high school full-time, has a reasonable expectation of graduating from high school and is living full-time with the person receiving the support.

The support order will terminate on the last day of a specific month rather than the exact graduation date. Although the court cannot order support after 19 1/2, the parties are free to agree to an extended period of support.

Hidden Income

In some cases, a spouse may attempt to minimize monthly payments by hiding income. This may be common if a spouse is involved in a cash business, or simply tries to hide income in other matters.

There are a few alternative methods for identifying a spouse’s additional income by looking at bank deposits, expenditures and financial statements that may have been used to gain a credit line or a loan. If you think your spouse is hiding income, you should contact a child support lawyer who can assist you with your case.

Temporary Orders

Either party, the court or the Michigan Friend of the Court may move for a temporary order of child support during the divorce proceedings, annulment or separate maintenance case.

A temporary order cannot be granted in Michigan unless a hearing is held or both parties agree to the order. This order can be modified, and remains in effect until a final judgment is in place.