Michigan Estate and Probate Attorneys

The process of probate can be a confusing and stressful experience. The situation becomes more complex when certain issues arise. For example, these issues may involve: dying without a will, legal disputes over inheritance, challenges to a will or trust, etc. Since these issues are highly complex, it’s vital to have your rights and interests protected by an experienced probate attorney who understands the legal process within the state.

The lawyers at Kelly & Kelly have over 30 years’ experience representing clients in matters related to estate planning and probate court. This knowledge is required for defending your legal rights, protecting assets, and minimizing the cost of probate court administration.

If you or someone you know has passed away without a will or is going through the Michigan probate process, call our experienced attorneys for a confidential consultation today.

How a Probate Attorney Can Help

The attorneys at Kelly & Kelly know the Michigan legal system inside and out and have decades of experience in various probate courts throughout the state. We handle all aspects of probate from the administration of assets, to estate litigation.

Below is a list of several aspects involving probate court that our law firm routinely handles.

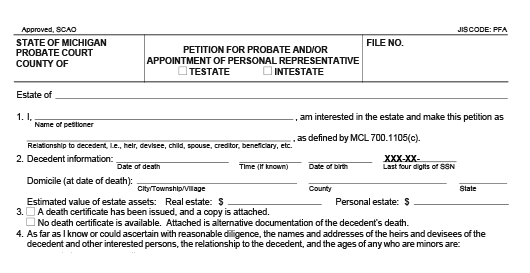

Probate Administration – When someone dies without a will or has property that requires administration, the court is required to oversee this process to ensure assets are distributed to the correct beneficiaries.

Probating Wills – Even when someone passes away with a valid will, their estate is typically required to go through probate. Wills do not guarantee the avoidance of probate. In fact, In Michigan, if you own any assets solely in your name upon your death, your estate will be subject to probate.

Trust Administration – The administration of a trust is more involved than that of a will. There are many complex legal requirements associated with trustees and their management of the trust assets. Kelly & Kelly represents trustees and beneficiaries through various complex legal legal matters.

Probate Litigation – When a potential beneficiary, or other party involved with a deceased individual’s estate raises a formal legal objection regarding the estate administration process, the case enters into litigation. Our law firm is highly experienced in probate litigation cases such as will contests, trust litigation, etc.

Guardianship & Conservatorship – Probate court handles the appointment of guardians and conservators and any legal disputes associated with them.

Probate Administration

When a loved one passes away, there’s often many questions regarding what happens to this person’s assets and property. The probate court may need to be involved with a decedent’s estate whenever the decedent passed away owning something solely in his or her name such as a bank account, real estate, or an investment account or life insurance policy without a beneficiary designation. There are several different types of probate court procedures depending on the assets involved and the value of those assets. This process is generally referred to as “probate administration.”

When a loved one passes away, there’s often many questions regarding what happens to this person’s assets and property. The probate court may need to be involved with a decedent’s estate whenever the decedent passed away owning something solely in his or her name such as a bank account, real estate, or an investment account or life insurance policy without a beneficiary designation. There are several different types of probate court procedures depending on the assets involved and the value of those assets. This process is generally referred to as “probate administration.”

In Michigan, you should look for a Last Will & Testament and burial plot deeds. Create an inventory of the decedent’s assets and property, physically secure any real estate, and collect the mail to discover accounts and debts. Keep all receipts for funeral and burial services and get multiple certified copies of the death certificate. Before paying any bills or making any distributions consult with an attorney to determine whether the probate court needs to be involved.

Probate and Conservatorship

There are times when a loved one is no longer able to manage their own financial affairs? If you find yourself in this position in Michigan, you may need to petition the probate court for conservatorship. A conservator is appointed by the probate court to “step into the shoes” of the incapacitated individual and manage the individual’s financial affairs. You may petition the probate court and nominate yourself to be appointed as conservator. Conservatorship is a huge responsibility to undertake for another and you should consult with an attorney before making any decisions about whether to proceed with this action.

Probate and Guardianship

When a loved one is no longer capable of making major decisions for themselves, you may need to petition the probate court for guardianship. In Michigan, both adults and minors can have a guardian appointed by the court. This power granted from the court, allows you as guardian to make decisions about medical treatment, physical placement of the individual, and allows the guardian to manage income of the individual. A conservator may also be needed if more significant assets are involved. One person can be both guardian and conservator or each position may be served by a different person.

Frequently Asked Questions About Probate

Q. My father drafted his own will and I am not sure he signed it properly or at all, can it still be probated or will all his stuff pass intestate?

In Michigan, you can probate a document or writing that was not executed in exact compliance with Michigan law but only if the proponent of the will establishes “by clear and convincing evidence” that the deceased intended it to be a will. A formal court proceeding is necessary to obtain a judge’s order that the document or writing is a valid will. Intent that a document constitutes your fathers will can be established by other evidence (lawyers call this extrinsic evidence) that may not be contained in the document itself.

Q. Our family recently lost a loved one, what are the first steps we should be taking? Where do we start?

It is important to share with your family your wishes, this way they know what you would have wanted when you are no longer around to supply instructions. Even if you do not share every detail of your estate plan, the location, or name of the law firm who assisted you in drafting your plan should be shared with close relatives so that they may begin carrying out our wishes. If you have a copy of a loved ones will or other estate plan documents, you should contact an attorney to guide you through the next steps.

Q. What happens if I cannot find my relatives will?

Many people prefer to be private about their affairs. Often the location of important documents like a will are hidden. There is a balance that must be struck between safeguarding the will to ensure that a family member does not tamper with it or protecting them from peeking at its contents and hiding it so well that no one can find it. If you can recall the name of the attorney who may have prepared such documents for a loved one, you should contact them immediately. If no will can be found, the case may proceed intestate, meaning the state rules for distribution will control.

Q. Can a copy of a will be used for probate?

When an original will cannot be found upon the death of a loved one, and the loved one that passed was in possession of the original, there exists a rebuttable presumption under the law that it was destroyed with the intent to revoke it. This presumption can be overcome with appropriate evidence that the loved one’s intent was not to revoke his or her will, and that the copy should be allowed to be probated to carry forth that person’s wish.

Q. What happens to property that I own with someone else when I die?

This question may have multiple answers, depending on how property is titled. Jointly held property with right of survivorship will pass to the other joint owner by operation of law upon a person’s death. Property that is held as tenants in common will not pass automatically, and the portion of the property titled in the name of a deceased individual, absent a proper estate plan, will have to go through the probate process before it can pass to another individual.

Q. What assets do not have to go through the probate process when I die?

Your estate plan does not govern the disposition of your property that is controlled by beneficiary designations or by proper titling and so passes outside your probate estate. These non-probate assets include property titled in joint names with rights of survivorship, payable on death accounts, life insurance, retirement plans and accounts, and employee death benefits.

These assets pass automatically at death to another person, and a will is not applicable to them unless they are payable to an estate by the terms of the beneficiary designations for them. A probate estate consists only of the assets subject to a will, or to a state’s intestacy laws if no will exist or is found, and over which the probate court (in some jurisdictions referred to as surrogate’s or orphan’s court) may have authority.

This is why reviewing beneficiary designations, in addition to preparing a will, is a critical part of the estate planning process. It is important to note that whether property is part of your probate estate has nothing to do with whether property is part of your taxable estate for estate tax purposes.