Michigan Elder Law Medicaid Planning

The experienced estate planning lawyers at Kelly & Kelly handle a wide variety of issues related to elder law and long term care planning. One of these issues involves medicaid planning for senior citizens. It’s important to note, there are several different types of Medicaid; our practice focuses on long term-care medicaid provided for elderly and disabled individuals.

Elder Medicaid Overview

Medicaid is a federally-funded, state run program that assists certain individuals with medical costs and provides aid for disability. In this case, medicaid helps elderly individuals with long term care once certain criteria are met. This includes long term care for nursing homes, assisted living, adult day care, home care, and more.

The qualification rules for Medicaid are quite confusing and complex. So, it’s important to speak with an experienced attorney that specializes in navigating the laws surrounding Medicaid.

Medicaid v.s. Medicare

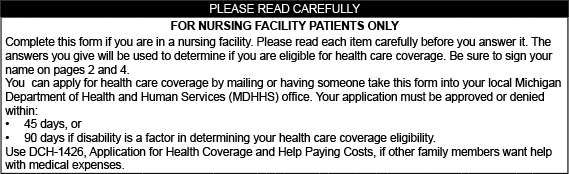

Medicaid and Medicare are different programs. Medicare provides healthcare to anyone 65 or older, regardless of income. After a 3 day hospital stay, Medicare will pay for 100 days in a rehabilitation center and/or a nursing home. Once the 100 day period expires, folks must pay out of pocket or apply for Medicaid to cover the extremely high costs of long term care. It’s important to note that all nursing homes do not accept Medicaid and a person must “qualify” for this type of government coverage. Thus, families must prepare in advance to protect assets and establish a sound plan to care for loved ones should the need arise.

Medicaid and Medicare are different programs. Medicare provides healthcare to anyone 65 or older, regardless of income. After a 3 day hospital stay, Medicare will pay for 100 days in a rehabilitation center and/or a nursing home. Once the 100 day period expires, folks must pay out of pocket or apply for Medicaid to cover the extremely high costs of long term care. It’s important to note that all nursing homes do not accept Medicaid and a person must “qualify” for this type of government coverage. Thus, families must prepare in advance to protect assets and establish a sound plan to care for loved ones should the need arise.

How An Attorney Helps With Elder Law Medicaid Planning

Lawyers specializing in elder care understand the ever changing federal and state rules and regulations surrounding Medicaid. For example, Medicaid has rules on how much money a person may keep before qualifying for benefits. Seniors must “spend down” their hard earned money until they reach this threshold amount.

A skilled attorney can provide methods to protect some of a family’s assets. One example of this is through establishing a living trust. Of course, each case is different and must be evaluated. A lawyer can explain which assets count and which are exempt from Medicaid’s “countable assets.” Your attorney will also discuss Medicaid’s 5 year “look back” policy regarding transfer of assets. Finally, an experienced attorney will assist families with establishing a solid estate plan.

Since every family’s situation is different; every estate plan must be tailored in a specific manner. Sadly, some people try to do this themselves, or use attorneys that don’t specialize in this area of law. Occasionally, people go to a Medicaid office to apply for benefits without proper legal advice. This mistake may cost the family a great deal of money. Consequently, being proactive and acquiring knowledge from the experts actually ends of saving money and eliminates stress during difficult times.