Wills Attorney in Northville

Writing a will is the foundation in establishing a proper estate plan. Wills help protect assets and provide comfort for loved ones in case of sudden tragedy or after someone’s natural, inevitable passing. Wills vary in complexity; however, the common theme in each of these documents is planning for the future and legally stating your final wishes.

In order for a will to be valid, it must be signed in the presence of witnesses and certain formalities must be followed. It’s highly recommended to use an experienced estate planning/will attorney to ensure this process is followed.

The estate planning lawyers at Kelly & Kelly have over 30 years’ experience in drafting and executing wills to ensure that your wishes are carried out.

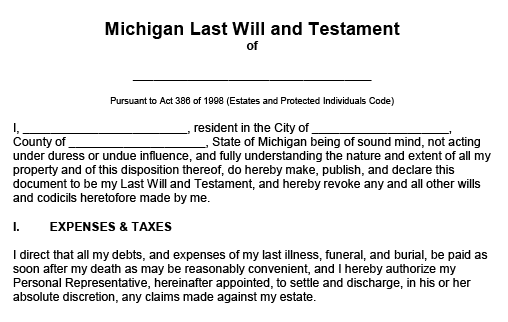

Last Will and Testament

The most common type of will remains the Last Will and Testament which is also referred to as the “Last Will,” or simply “Will” for short. In Michigan a Last Will & Testament provides you the ability to make several decisions about what happens after you pass away.

The most common type of will remains the Last Will and Testament which is also referred to as the “Last Will,” or simply “Will” for short. In Michigan a Last Will & Testament provides you the ability to make several decisions about what happens after you pass away.

– First, it allows you to decide who gets your property including cash, personal property, family heirlooms, and real estate.

– Second, a Will permits you to nominate a Personal Representative of your estate – the person who will have the authority to pay your debts, settle any claims, and distribute your assets to the proper beneficiaries.

– Third, if you have minor children, a Will sets forth who you want to take care of your children upon your death.

Pour-Over Will – A Pour-Over Will is a type of Last Will and Testament that is prepared in connection with a trust. A trust can be funded (property transferred into the trust) after death through the use of this document. The trust, which contains the instructions on how you would like the assets it will contain treated, is created and formed while you are alive like any other trust, but is funded by instructions in your will.

Wills v.s Trusts

Other than wills, trusts are another common document involved in an estate plan. There are several misconceptions about wills and trusts. Most notably, that you should choose one or the other. The truth is, although wills & trusts both involve planning for the future, they serve different purposes and each provide their own unique benefits.

For instance, a will provides outright gifts and have no complex provisions in creating future interests or establishing trusts. Although a will is an integral part of almost every estate plan, it alone may not adequately meet your needs. Depending on your needs and wishes, a trust/will combination may be the best course of action. The estate lawyers at Kelly & Kelly P.C. have decades of experience in helping clients with simple or complex estate plans and provide comprehensive guidance in selecting the most suitable plan for your needs.

Frequently Asked Questions About Wills

Q. Why do I need a lawyer to draft my will, can’t I just get preprinted forms off the internet?

Just like using the internet to diagnose an illness or health condition, the use of preprinted trust and estate forms and documents must be utilized with great caution. A licensed trust and estate attorney is trained and experienced in the area of creating a custom estate plan that can minimize or eliminate many of the headaches and troubles that can arise from an improperly or poorly crafted plan.

An estate planning attorney can help minimize tax consequences and maximize the ease at which an individual’s final wishes are carried out. You would not trust your health to a diagnosis found on websites like WebMD alone, so why would you risk assuming your family’s financial future is secure based on forms not specifically drafted with your wishes in mind?

Q. I wrote my own will, but I was told that it was not properly executed. How is a will supposed to be executed?

In order for a will to be valid it must be signed in the presence of witnesses and certain formalities must be followed. A lawyer can help you with the drafting and execution of a will to ensure that your wishes are carried out.

Q. Do I need a will?

Wills can be of various degrees of complexity and can be utilized to achieve a wide range of family and tax objectives. If a will provides for the outright distribution of assets, it is sometimes characterized as a simple will. Even a simple will has advantages over proceeding without a will. You should always review your goals with a trusted advisor.

Q. Besides leaving instructions for who gets my property when I die, what else can a will contain?

The answer here is limitless. Wills can be utilized not only to distribute assets as you desire, but can also be used to establish guardianship for minor children, establish trusts for future generations, provide for distributions for charities, or even provide for specific funeral and burial instructions in conformity with personal or religious traditions.

Q. I already have a will, how often does it need to be updated?

Anytime there is a major change in either a person’s financial situation (such as buying a new home or vacation home or starting a new retirement plan) or family situation (such as the birth of a child or grandchild) is a great time to revisit your current estate plan. A will alone may not be sufficient to accomplish the goals you have for family. On average, a person should update their estate plan every five (5) to seven (7) years.

Q. I do not want to revoke my old will, but I just want to add additional instructions. Do I have to redraft my entire will?

No, a will can be supplemented by what is called a codicil. This acts as an addendum to the will, supplying additional instructions to be read in conjunction with your existing will. Great care must be given when drafting a codicil. Any terms of the codicil that contradict the existing will, will be the controlling terms followed by the court and your personal representative.