Michigan Estate Planning & Estate Litigation

Many people think that creating a will is sufficient in avoiding probate and planning a comfortable future for their family. Unfortunately, in many cases, this is far from the truth. Creating a will is a great place to start; however, if your family owns high value assets or property in other states (i.e. a cabin up north, vacation property, real estate), then it’s advised to work with an experienced estate lawyer to ensure your estate plan covers these assets.

Many people think that creating a will is sufficient in avoiding probate and planning a comfortable future for their family. Unfortunately, in many cases, this is far from the truth. Creating a will is a great place to start; however, if your family owns high value assets or property in other states (i.e. a cabin up north, vacation property, real estate), then it’s advised to work with an experienced estate lawyer to ensure your estate plan covers these assets.

Not taking the proper measures in your estate plan will result in unnecessarily high fees, taxes, administration expenses and potential problems in probate court.

Kelly & Kelly P.C. has over 30 years of experience in Michigan estate planning and estate litigation cases. Our lawyers have the knowledge, experience, and dedication to ensure your assets are protected and reach their rightful heirs.

How We Can Help

The estate lawyers at our firm have a vast amount of legal experience in several areas related to estate planning and probate court. You can read more about these individual areas within the links below.

Probate – When someone dies without a will, has property that requires administration/division among several beneficiaries, or is involved in a legal dispute over inheritance, probate court will oversee the case. Our law firm has over 30 years’ experience navigating the complex issues involved with probate.

Probating Wills – Even when someone passes away with a valid will, their estate is typically required to go through probate. Wills do not guarantee the avoidance of probate. In fact, In Michigan, if you own any assets solely in your name upon your death, your estate will be subject to probate. Probate will be required to transfer such assets out of your name and distribute them to your beneficiaries or heirs. In order for your estate to avoid probate court proceedings, you will need a trust and/or beneficiary designations to address proper transfer of all assets upon your death.

Patient Advocate Designation – In the State of Michigan, unless you designate a Patient Advocate no one is legally permitted to make medical decisions in the event you cannot make them for yourself, with one exception. The only exception to this rule is that of a parent-minor child relationship.

Conservatorship – The appointment of a conservator involves delegating power to someone to manage financial affairs and other aspects of another individual’s life. In Michigan, an appointed conservator could be an individual, a corporation or a professional conservator.

Guardianship – Similar to conservatorship, our attorneys help with the legal aspects involved with temporary guardianship, limited guardianship, adult guardianship, and guardianship over a minor.

Elder Law – Elderly individuals have unique legal needs which requires specific legal expertise. This may include Medicaid planning, long term care, and more.

Healthcare Directives – An advance healthcare directive is an aspect of estate planning that allows someone to express values and desires related to end-of-life care. An example of this is a Patient Advocate Designation.

Medicaid Planning – There are many complicated issues surrounding Medicaid planning and nursing home care for senior citizens. Our law firm is dedicated to ensuring elders receive affordable nursing home care through the federally funded program of Medicaid.

Power of Attorney – A durable power of attorney (POA) is a document by which a principal designates another as the principal’s attorney. In other words, someone can make important decisions on behalf of another individual in a crisis situation.

Trust Administration – Trust administration involves the trustees management of trust assets and property based on terms laid out within the document. Trustees have many important roles and legal requirements. Kelly & Kelly represents trustees and beneficiaries through various complex legal legal matters.

Last Will & Testament

Wills are the foundation in any estate plan. In Michigan, a Last Will & Testament provides you the ability to make several decisions about what happens after you pass away.

– First, it allows you to decide who gets your property including cash, personal property, family heirlooms, and real estate.

– Second, a Will permits you to nominate a Personal Representative of your estate – the person who will have the authority to pay your debts, settle any claims, and distribute your assets to the proper beneficiaries.

– Third, if you have minor children, a Will sets forth who you want to take care of your children upon your death.

Joint Ownership Bank Accounts

The effect of adding a second person to your bank account is joint ownership and increased liability. Upon the death of a joint account holder, the account automatically passes to the surviving owner. The assets in a joint account are subject to collection by creditors of either joint owner. A better approach is to have a Durable Power of Attorney in place. This legal document allows a person you choose to manage your finances for you at your direction or when you are unable to do so.

Estate Planning Frequently Asked Questions

Q. What does an estate plan encompass?

A proper estate plan takes into account all of an individual or family’s assets including, but not limited to, bank accounts, real property, personal property, life insurance, retirement, educational accounts as well as all debts and liabilities. A person’s estate plan will utilize documents such as wills, letters of instruction, revocable trusts, irrevocable trusts, health care derivatives, funeral instructions etc., to ensure that your final wishes are carried out while avoiding many of the pitfalls that a protracted probate process can entail.

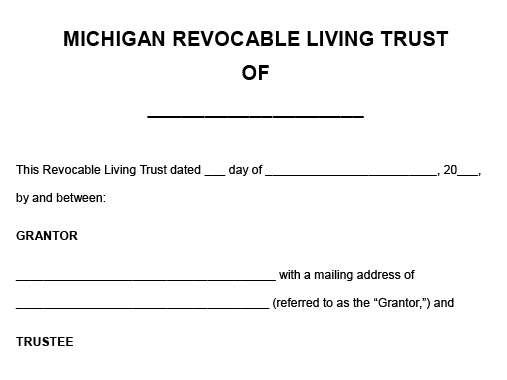

Q. Why do I need a lawyer to draft my will, can’t I just get preprinted forms off the internet?

Just like using the internet to diagnose an illness or health condition, the use of preprinted trust and estate forms and documents must be utilized with great caution. A licensed trust and estate attorney is trained and experienced in the area of creating a custom estate plan that can minimize or eliminate many of the headaches and troubles that can arise from an improperly or poorly crafted plan.

An estate planning attorney can help minimize tax consequences and maximize the ease at which an individual’s final wishes are carried out. You would not trust your health to a diagnosis found on websites like WebMD alone, so why would you risk assuming your family’s financial future is secure based on forms not specifically drafted with your wishes in mind?

Q. My father drafted his own will and I am not sure he signed it properly or at all, can it still be probated or will all his stuff pass intestate?

In Michigan, you can probate a document or writing that was not executed in exact compliance with Michigan law but only if the proponent of the will establishes “by clear and convincing evidence” that the deceased intended it to be a will. A formal court proceeding is necessary to obtain a judge’s order that the document or writing is a valid will. Intent that a document constitutes your fathers will can be established by other evidence (lawyers call this extrinsic evidence) that may not be contained in the document itself.

Q. Will all my assets just go to my wife and kids if I do not have a will?

Your non-jointly held probatable assets will not simply pass to any individual without a probate estate being opened in court and a judge ordering your property transferred in compliance with the law. If you die intestate (without a will), Michigan law, or the law of the state you are domiciled in at the time of your death, will determine who receives your property by default. That plan may or may not reflect your actual wishes, and some of the built-in protections may not be necessary in a harmonious family setting.

A proper estate plan allows you to alter the state’s default plan to suit your personal preferences. It also permits you to exercise control over a myriad of personal decisions that broad and general state default provisions cannot address, and further can assist you in avoiding or minimizing the often expensive and tedious process that probate court can entail.

Q. My wife and I want to ensure that our home goes to our kids when we die, what options do we have to avoid probate besides a will or trust?

An enhanced life estate, also known as a Ladybird Deed (sometimes written Lady Bird Deed) in one option. A Ladybird Deed allows you to keep a life estate in the property and grants a remainder to the person or persons of your choosing. Michigan probate courts have held that once the grantor is deceased, the property vests as a transfer on death in the individual or individuals named as your remainderman or remaindermen. Your estate has no interest in the property and the property is out of the reach of creditors of the estate. The property would be considered a non-probate asset.

Estate Lawyer With 30+ Years’ Experience

Attorney John Kelly is the founder and managing partner of Kelly & Kelly P.C, a Northville, Michigan based law firm specializing in estate planning, probate, and several other practice areas. For over 30 years John has served the local community by providing high quality estate planning expertise. If you require legal guidance on your estate, contact the offices of Kelly & Kelly today.