What Every Property Owner Should Know

The Lady Bird Deed is a very useful estate planning tool that every property owner in Michigan should know about. Many people believe that creating a will, either with an attorney or through some online form ordered from a late-night TV commercial, that they have successfully avoided probate. This could not be any further from the truth and what you don’t know will cost your family members and loved ones a great deal of time and money.

Real property (i.e. a home, cabin up north, vacation property, vacant land) which is owned by one or more individuals will require probate once the final living owner passes away. Even worse, that probate must be filed in the county where the property is located. This means that if you or a family member owns that vacation home in Naples, you will need to retain a Florida licensed attorney to probate that property. You can read more on the rules of Florida probate in this article here.

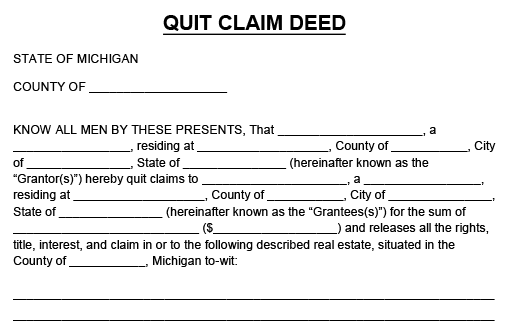

One solution to the probate dilemma is to add other people to the deed. However, this resolution is fraught with catastrophic problems, including possible uncapping, unintended divesting, and hindering a person’s ability to sell, mortgage or lease their own property. This is especially problematic for younger couples who own their first home.

So, what can be done to avoid probate, guarantee the property passes after your death, but not hinder your ownership rights while you are still alive? Three words, Lady Bird Deed.

Avoiding Probate With The Lady Bird Deed

A Lady Bird Deed, often called an Enhanced Life Estate, Transfer on Death Deed, or Beneficiary Deed, depending on what state your real property is located in, allows the owner or owners to name a trust, individual, or even group of individuals who will inherit the property right in the deed. This means the property will pass automatically upon the owner’s death and avoid probate. Not only will the property avoid probate, but during the property owner retains their right to sell, lease, mortgage, rent, or otherwise alter or dispose of the property as they wish during their life, without the need to obtain signatures or permission from the beneficiaries they name. This means the owner retains full control while simultaneously insuring that the property will avoid probate. The best part, a properly drafted deed will cost you less then the court costs and fees incurred in even the smallest probate estate.

A Lady Bird Deed, often called an Enhanced Life Estate, Transfer on Death Deed, or Beneficiary Deed, depending on what state your real property is located in, allows the owner or owners to name a trust, individual, or even group of individuals who will inherit the property right in the deed. This means the property will pass automatically upon the owner’s death and avoid probate. Not only will the property avoid probate, but during the property owner retains their right to sell, lease, mortgage, rent, or otherwise alter or dispose of the property as they wish during their life, without the need to obtain signatures or permission from the beneficiaries they name. This means the owner retains full control while simultaneously insuring that the property will avoid probate. The best part, a properly drafted deed will cost you less then the court costs and fees incurred in even the smallest probate estate.

If you or a loved one own property contact Attorney John Kelly at Kelly & Kelly to discuss how this simply and inexpensive deed can save you and your thousands in probate fees and costs and avoid the need to file a probate action in every county of every state your property is located in!