All About Ancillary Probate & How to Avoid it

The change of season signals the use of vacation homes. In the winter, it is the snowbirds leaving the north for Florida and all points south for a reprieve from the cold. In the summer, the Friday afternoon highways are filled with cars as people begin heading north to their cabin or cottage. If you’re lucky enough to own such a property, great care and planning is taken in maintaining your seasonal hideaway. But have you forgotten to plan what happens to your personal escape if and when you pass away?

This article discusses the topic of Ancillary Probate in Michigan. Specifically, how to avoid this process and protect property when you or a loved one pass away.

What is Ancillary Probate?

Simply put, ancillary probate is a court-supervised process involving a deceased individual’s assets, specifically, real estate assets (i.e. vacation homes). This is an additional process to regular probate proceedings which involve distribution of a decedent’s inheritance in accordance with their estate plan.

Many individuals forget to list real estate assets within their estate plan or will; thus, are subject to the additional process of ancillary probate.

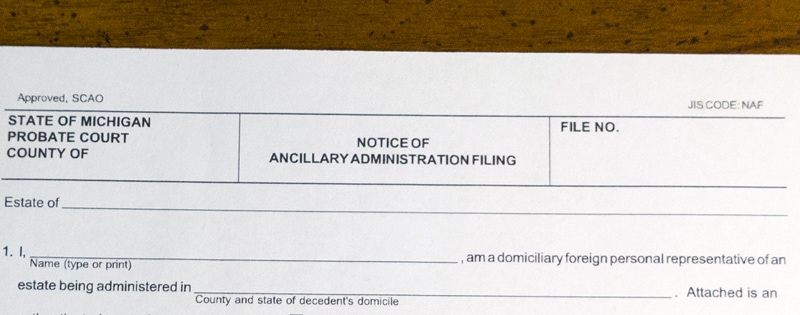

If this occurs, one must file a file a petition for probate within the local county court where the deceased individual resided at the time of death. The document used in this filing is called a “Notice of Ancillary Administration Filing.” You can see an example of this document here.

Drawbacks

What most people do not realize is that failure to properly include your real estate in your estate plan could subject you to having to open a probate estate in every county in every state where real estate is located. That means that while your family may love to join you at your timeshare in Orlando, Florida, they would be forced to file an ancillary probate action in Orange County, Florida, regardless of the fact you lived and died in Michigan.

Same holds true for that cabin in Northern Michigan. Your family may have fond memories of their summer trips up north, but the last thing that they want to do is attend mandatory hearings in the local circuit court on the probate of your family cottage.

The solution to this problem is quicker and cheaper than you think. Clients are often surprised and amazed at how easy and affordable it can be.

You do not have to have a complex trust or will to properly protect your real estate. In fact, you could protect that real estate with no will at all!

Probate Laws and Rules

Each state has their own set of rules and regulations when it comes to probating real estate.

In Michigan for example, when someone is interested in purchasing or selling real estate, there is sometimes a question regarding who rightfully holds the title or deed to the property.

This comes about usually due to a person passing away without a proper will or failing to deed a property to their heirs before passing. Without a proper will or deed from the decedent, a home cannot be legally sold, refinanced or owned by any person other than the decedent’s estate.

Other states such as Florida, do not recognize property transfer on death deeds; thus, real estate may not be transferred in this manner. In fact, if a married couple does not own property jointly, probate court follows Florida’s state intestacy laws. In this situation, the surviving spouse may not inherit the entire property. In other words, other family members may receive a fraction of the real estate.

As a Michigan based law firm, we get a fair amount of questions on both Michigan and Florida probate since there are a lot of “snow birds” that migrate down to Florida during the cold winter months in Michigan.

Here’s an article that explains probate laws in Florida for the benefit of our readers.

https://ddpalaw.com/blog/probate/florida-probate-rules/

What Can You Do?

The experienced probate lawyers at Kelly & Kelly P.C. can assist you in ensuring that your beloved vacation spot remains a beloved vacation spot without first becoming a probate nightmare for those you love.

If you or someone you know owns property, please have them contact the attorneys at Kelly & Kelly P.C. to find out how we can help you plan for the vacations ahead.